“How FinTech is dismantling legacy banking and why your smartphone is now the most secure vault in the world.”

Introduction:

Why Your Bank is Stuck in the 90s

Let’s be honest: visiting a physical bank branch feels like a chore from a bygone era. Long queues, endless paperwork, and the dreaded “lunch break” delays are not just frustrating — they are expensive. In a world where you can order a meal or a cab in seconds, waiting three days for a simple bank statement feels prehistoric. Most people feel trapped in a financial system that’s slow, reactive, and unnecessarily complicated.

The Decoding Promise: In this guide, I’m stripping away the technical jargon of the FinTech world to show you exactly how Neo-banking (digital-only banking) is fixing these pain points. By the end, you’ll understand why the future of your money is on your smartphone, not in a concrete building, and how this shift is saving people thousands in hidden costs.

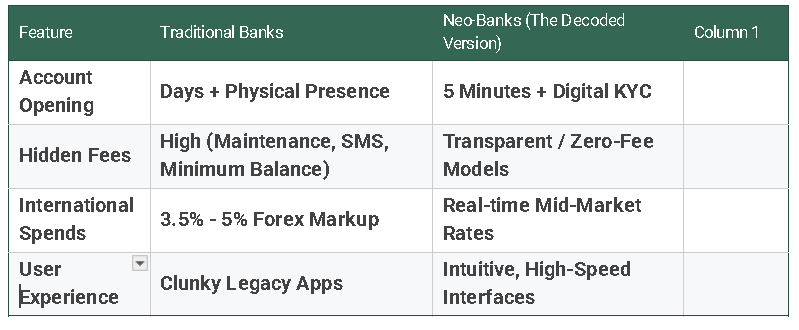

At a Glance: Neo-Banks vs. Traditional Banks

1. 5-Minute Digital Onboarding (The End of Paperwork)

The first hurdle with traditional banking is the “Entry Barrier.” Legacy institutions require you to print forms, carry physical ID photocopies, and often wait for a representative to verify your signature.

The Decoder Reality: Neo-banks utilize AI-driven e-KYC (Know Your Customer) systems. By leveraging your smartphone’s camera and government-verified databases, they can verify your identity in real-time. You scan your ID, take a quick “liveness” selfie to prevent fraud, and your account is active before you can finish your cup of coffee. This isn’t just a convenience; it’s a fundamental shift in accessibility for the 2026 digital economy.

2. The Eradication of “Zombie” Fees

Traditional banks operate with massive overhead costs — rent for thousands of branches, electricity, and a massive on-ground workforce. To sustain this, they “nickel and dime” customers with maintenance charges, SMS alert fees, and minimum balance penalties.

The Decoder Reality: Neo-banks are “Cloud-Native.” Because they don’t have physical branches, their operational costs are nearly 70% lower than traditional banks. They pass these savings to you. This is why “Zero-Balance” accounts are the standard here, not the exception. When you see “Zero Fees,” it’s not a marketing gimmick; it’s a structural advantage of the technology they use.

3. Hyper-Personalized Wealth Insights

Most people don’t know where their money goes until they check their statement at the end of the month. By then, it’s too late to fix bad spending habits.

The Decoder Reality: Neo-banks offer real-time analytics. Every time you swipe your card, the transaction is instantly categorized (Food, Travel, Shopping).

- Visual Data: You get an interactive monthly pie chart of your spending.

- Predictive Alerts: Some apps even warn you if your current spending pace will leave you short for your upcoming rent or utility bills. It’s like having a financial advisor in your pocket who works 24/7.

4. Disposable Virtual Cards: The Security Shield

Online fraud is a growing nightmare. Every time you enter your debit card details on a new website, you’re taking a risk. If that website’s database is hacked, your entire bank account is vulnerable.

The Decoder Reality: Neo-banks allow you to generate “Disposable Virtual Cards” with a single tap. These are digital-only cards with their own 16-digit number and CVV. You can use a card for a one-time purchase, and it “self-destructs” immediately after. Even if the merchant’s data is leaked, the hackers have a dead card number that is useless. This feature alone provides a level of digital peace of mind that traditional banks simply haven’t caught up with yet.

5. Interbank Exchange Rates (The Forex Revolution)

If you are a remote freelancer working with international clients or a frequent traveler, traditional banks are your biggest enemy. They often charge a “Forex Markup” of 3% to 5% on every transaction.

The Decoder Reality: Neo-banks use the “Mid-Market Rate” — the same rate banks use to trade with each other. By removing the middleman, they allow you to spend or receive money in multiple currencies without the hidden “tax” of legacy banking. For someone spending $10,000 abroad annually, this feature saves roughly $500 — money that stays in your pocket instead of the bank’s profit margin.

6. Automated “Micro-Savings” (Wealth on Autopilot)

Saving money is hard because it requires discipline. Traditional banks expect you to manually move money into a savings vault, which most people forget to do.

The Decoder Reality: Neo-banks introduce “Round-Ups.” If you buy a coffee for $3.40, the app rounds it up to $4.00 and automatically puts that $0.60 into a separate high-yield savings vault. It’s “painless” saving. Over a year, these micro-transactions can build a significant emergency fund without you ever feeling the pinch in your daily budget.

7. Modern Security: Why Your Money is Actually Safer

A common misconception is: “No physical building = No safety.” In reality, the “concrete wall” of a bank is an illusion of safety in a digital world.

The Decoder Reality: Neo-banks often use 256-bit AES encryption — the same standard used by intelligence agencies. Furthermore, most operate under a “Banking Service” license or partner with established, regulated banks.

- The “Partner Bank” Secret: Always scroll to the bottom of a Neo-bank’s website. You will see they are backed by national insurance (like the FDIC or DICGC). Your money isn’t floating in the cloud; it’s held in a regulated ecosystem, but accessed through a vastly superior interface.

Conclusion: The Shift is Inevitable

The world is moving toward friction-less finance. Neo-banking isn’t just a trend for Gen-Z; it’s a structural shift in how humanity interacts with value. It simplifies the complex, eliminates the middleman, and finally puts the power of a global Swiss bank account right in your pocket.

The question isn’t whether you will switch to a Neo-bank — it’s when. In 2026, staying with a traditional bank is like using a typewriter in the age of AI.

Ready to upgrade your financial life? If you’re a FinTech brand looking to translate complex tech into stories that convert, let’s talk. I don’t just write articles; I decode industries. Hire me to decode your next big project.

7 Game-Changing Neo-Banking Features That Will Make You Ditch Traditional Banks was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.