Legal expert Bill Morgan has rejected claims that XRP is approaching a supply shock, citing exchange balance and ETF data showing that a large volume of tokens remains available for trading. Morgan’s comments came in response to arguments that declining XRP balances on centralized exchanges could trigger scarcity and drive prices higher. He said the figures do not support that conclusion.

Exchange Balances Show 15% of Total Supply On-Platform

According to exchange balance data referenced in the discussion, 15,4 billion XRP are currently held across 26 centralized exchanges. Morgan noted that this represents 15% of fixed total supply of 100 billion tokens and about 25% of the circulating supply, which stands near 60.67 billion.

Morgan said a supply shock would require a meaningful shortage of liquid XRP on exchanges. Current balances, he argued, allow buyers and sellers to transact at scale without facing scarcity.

In response to claims that most XRP held on exchanges is illiquid because it sits in retail accounts, Morgan said this point does not change the analysis.

He stated that he is already aware that part of exchange-held XRP is illiquid and emphasized that even after accounting for that factor, the remaining liquid token on exchanges remains substantial. Morgan added that distinguishing between “total” and “available” supply does not support the supply shock thesis under current conditions.

Crypto commentator Zach Rector has pointed to falling balances on exchanges, particularly on Binance, as evidence that liquidity could tighten. Morgan rejected that interpretation, saying the presence of more than 15 billion XRP on exchanges contradicts claims of an imminent supply crunch.

Among individual exchanges, Upbit holds the largest XRP balance, with about 6.25 billion XRP spread across 13 wallets. Binance follows with roughly 2.52 billion tokens across 21 wallets, while Bithumb holds around 1.82 billion tokens in nine wallets. Other exchanges collectively hold several billion additional XRP.

Morgan said these balances indicate that XRP liquidity on trading platforms remains deep.

XRP ETF Holdings Too Small to Constrain Supply

Morgan also addressed claims that spot XRP ETFs could contribute to a supply shock. The ETFs hold about 679.14 million XRP, equal to 0.67% of total supply, with a combined net asset value near $1.27 billion.

Morgan said ETF ownership at that level is insufficient to restrict circulation, contrasting the token with Bitcoin, where ETFs absorbed a materially larger share of supply.

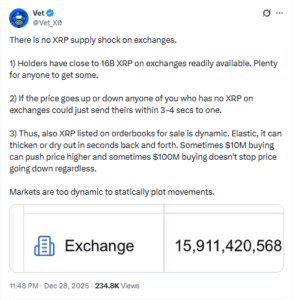

XRPL dUNL validator Vet supported Morgan’s view, noting that XRP can be transferred to exchanges within seconds. He said traders can quickly move tokens to trading platforms during periods of volatility, replenishing exchange liquidity when prices move.

This transfer speed further weakens arguments that declining balances alone can create sustained scarcity.

Morgan summarized his position by stating that the issue with XRP is not exchange balances but the lack of a rational basis to predict a price spike driven by a supply shock.