Crypto exchange BTSE has enabled USDC deposits and withdrawals on the XDC Network on Dec. 17. The launch allows users to transfer the dollar-pegged stablecoin through XDC Network infrastructure, adding a new settlement option alongside existing USDC-supported blockchains.

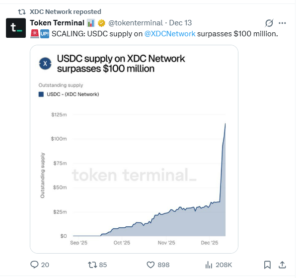

USDC Supply on XDC Surpasses $100 Million

The BTSE listing follows a steady rise in USDC usage on the XDC Network. Data shared by Token Terminal on Dec. 13 shows that outstanding USDC supply on XDC has surpassed $100 million.

The growth in circulating USDC suggests that stablecoin activity on XDC was already building prior to the BTSE integration, with exchange support now providing additional liquidity access points.

The expansion of USDC settlement options also comes after XDC Ventures acquired Contour Network in October, a digital trade-finance platform previously backed by banks including HSBC and Standard Chartered.

You May Also Like: Can XDC Network Turn Blockchain Into Business?

That acquisition included plans to develop a Stablecoin Lab focused on regulated settlement and cross-border trade workflows. The addition of exchange-level USDC transfers provides a functional layer that aligns with those earlier trade-finance and settlement initiatives.

Beyond BTSE, Bybit has also enabled USDC support on the XDC Network. In a separate update, investment platform Mudrex confirmed that it now supports XDC Network transfers, allowing users to move USDC using XDC rails.

With BTSE, Bybit, and Mudrex now supporting USDC transfers via XDC Network, the blockchain has gained multiple exchange and platform entry points for stablecoin settlement.

Stablecoin Growth Coincides With Rising RWA Activity

The increase in stablecoin settlement activity on XDC coincides with rising real-world asset (RWA) issuance on the network. According to RWA Monitor data, XDC ranks as the second-largest blockchain for RWA issuance in Brazil. Approximately $140 million (R$700 million) in tokenized assets are already issued on-chain.

The issuance activity links to projects developed with Vert Capital and Liqi Digital Assets. These projects focus on regulated private credit and tokenized financial instruments.

Unlike token listings that introduce new trading pairs, recent USDC integrations on XDC focus on stablecoin movement. These include deposits, withdrawals, and cross-platform transfers.

USDC is commonly used for payments, treasury operations, and cross-border settlement. Exchange-level support on XDC allows these activities to take place using a network designed for fast confirmation times and low transaction costs.