Hedera’s distributed ledger has been selected by SWIFT to test cross-border payment settlement, placing the network alongside Ripple’s XRP in live trials. The initiative marks a significant step for the blockchain, which operates with 10,000 transactions per second, low fixed fees, and instant finality.

The SWIFT pilot will begin in November with participation from banks in North America, Europe, and Asia. The program will test tokenized assets and instant settlement processes within SWIFT’s infrastructure. Hedera, which has already achieved Technology Readiness Level 9, the highest designation for financial systems, is being positioned as enterprise-ready for large-scale use.

Potential Integration Into $150 Trillion Payment Flows

SWIFT handles more than $150 trillion in annual global transactions. Even limited integration of Hedera’s technology into this network could generate substantial demand. Market analysts note that the collaboration reflects a wider push to merge blockchain settlement layers with established financial rails.

The trials add to Hedera’s momentum in positioning its technology for institutional adoption. By aligning with SWIFT, Hedera places itself at the center of global payment modernization efforts, with tokenization and real-time settlement forming the backbone of the tests.

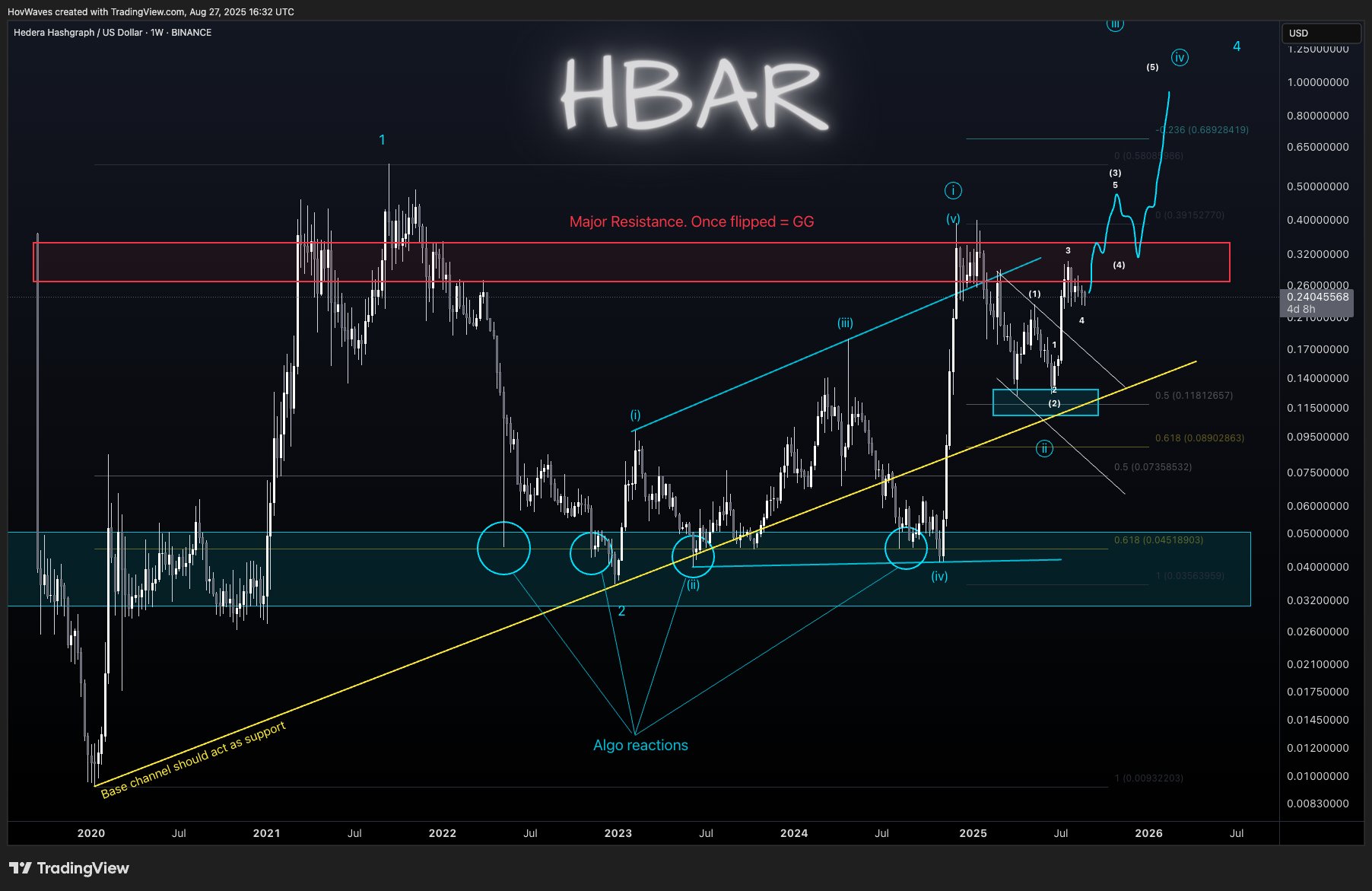

HBAR Faces Key Resistance With Wave Pattern Setting Up Potential Breakout

Hedera’s token HBAR has entered a decisive phase after retesting the entry level flagged in earlier analysis and rallying more than 100 percent. The move confirmed the strength of support zones while pushing the token toward a major resistance band that now shapes its short-term outlook.

Analyst Hov (@HovWaves) explained that HBAR has formed only three waves off its recent low, meaning the structure still lacks the full five-wave sequence typically required for a sustained rally. At present, the token appears to be in the fourth leg of its third wave. This setup signals that another upward push remains possible, provided the token can break above immediate resistance.

The HBAR/USDT chart outlines how critical this resistance zone has become. Previous attempts to cross it have failed, capping upward momentum. If HBAR clears the level, the move could trigger strong momentum and accelerate price discovery, supported by a broader five-wave completion. Until then, the resistance remains a ceiling rather than a buying opportunity, as Hov noted, stressing that entries at resistance carry greater risk.

Meanwhile, the base channel highlighted in yellow continues to act as structural support. Historical reactions along this line have provided reliable rebounds, keeping the bullish trajectory intact. A successful retest of this support area would offer traders a more favorable entry point compared with chasing positions into resistance.

In short, HBAR’s next phase depends on its ability to break past its immediate resistance. A confirmed move higher would validate the five-wave structure and unlock additional momentum, while failure to do so would likely force consolidation within its current range.