Mineral processing monitoring and automation is rapidly moving far beyond just control rooms with grey DCS screens – fundamentally, instead of just seeing real time data from sensors, is the realisation of the power of what you can achieve with that data in areas like predictive and proactive maintenance.

For the forthcoming January 2026 issue of International Mining, IM Editorial Director Paul Moore sat down with Arttu-Matti Matinlauri, Metso Vice President, Minerals Segment Digital, at the company’s HQ in Espoo, Finland, to try to understand the evolution that is going on in mineral concentrators today.

IM Editorial Director Paul Moore sat down with Arttu-Matti Matinlauri, Metso Vice President, Minerals Segment Digital at Metso HQ in Espoo

By turning vast streams of data into actionable insights, digitalisation is reshaping the way minerals processing is understood and optimised – and thus driving a more efficient, sustainable future for the industry. Metso’s Data-driven Performance Services offer solutions for efficient information flow between the customer and Metso to improve reliability and productivity of customer’s assets. Matinlauri says these solutions enhance informed decision-making and action-taking on-site by combining data analytics with OEM expertise in the form of remote monitoring and data-driven expert support.

Data generation and collection enables algorithm development to monitor equipment health and process performance. Metso has developed such algorithms to identify issues and predict failures on connected customer equipment. As an OEM with decades of accumulated know-how in mining equipment and minerals processing, Metso embeds this unique knowledge into algorithm development to increase customer value.

“The starting point of Data-driven Performance Services is the combination of data analytics, artificial intelligence and OEM expertise. This technical baseline built on decades of resolved incidents on Metso equipment enables us to scale our knowledge for a global customer base,” says Matinlauri. “Our predictive analytics for condition monitoring detect equipment-related issues, and through this service, we help customers mitigate issues and prevent failures to improve availability and reliability.”

When an issue is identified through condition monitoring, Metso’s remote monitoring experts from a regional Performance Center start data-driven investigation to prepare an actionable issue resolution plan for the customer. When meaningful, they collaborate with a global Performance Center network as well as Metso’s global Technical Support.

Matinlauri emphasised that the reality of what you achieve with process plant data is a partnership journey together with mining customers – taking them from a position of ‘do I need all these optional sensors’ to the sensor data output and its interpretation becoming an inherent part of lifecycle and maintenance savings and efficiency. He added that the challenge is that you can only really understand the value of these systems once they’re running; and when you have the people and the software in place that can interpret it in a useful way. After the implementation many customers realise the changes they can do to their standard operating procedures thus bringing efficiency for example to daily inspections.

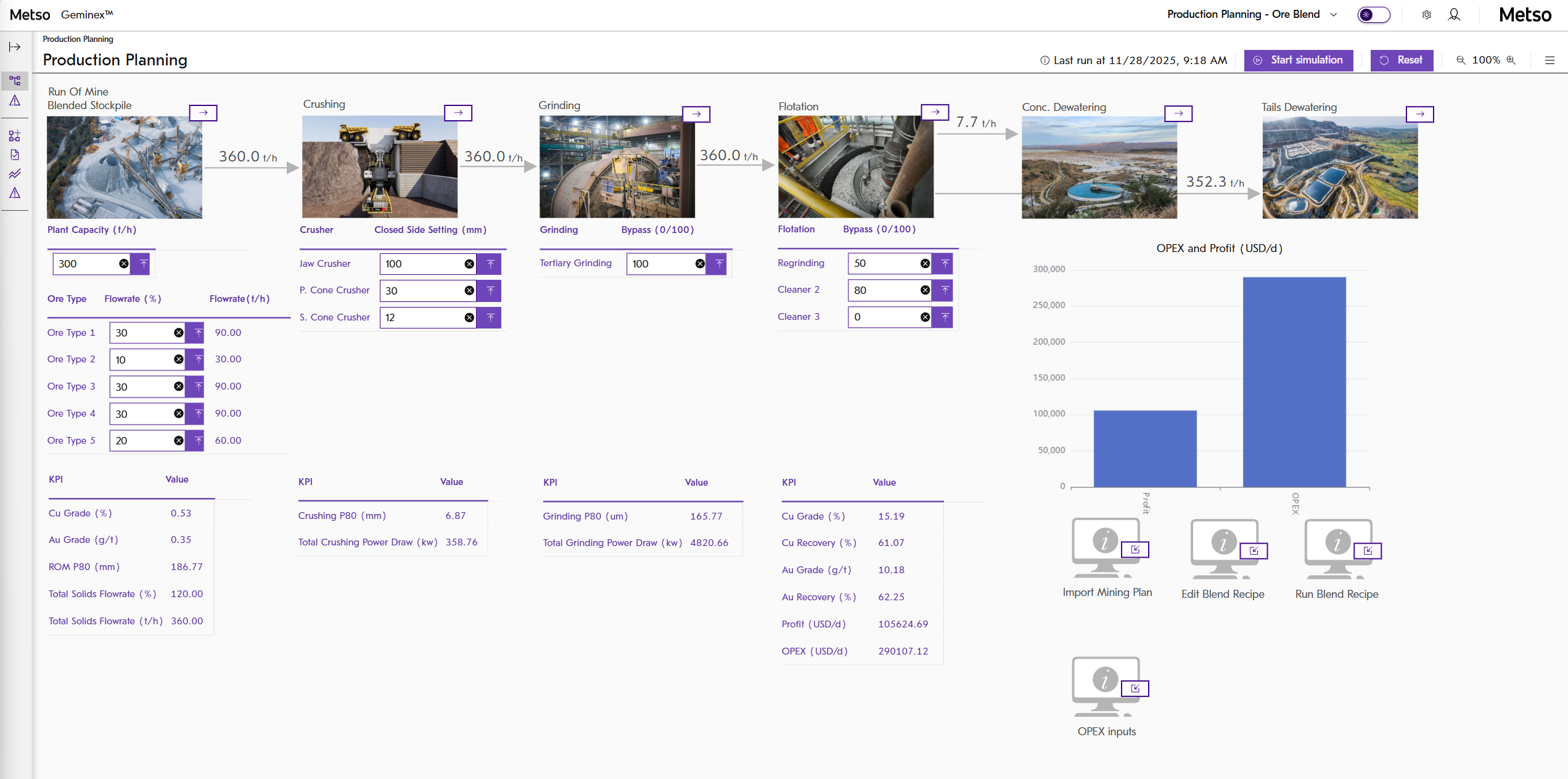

Screenshot from Geminex showing Production Planning inputs

“Today, some instrumentation is factory installed as standard, and some of it is retrofitted. Some of the optional retrofits of today are ultimately going to become standard instrumentation. And that’s because you move from sensors being a process control only thing only to how does this actually impact my total cost of ownership and my lifecycle costs, because I’m able to use it to identify maintenance issues or reliability issues. And I think that’s the realisation or the wave that we’re now starting to see in the marketplace.”

Maintenance does still reside as a second tier of interest after actual operations. “But that is changing and from our side that’s also starting to impact how we approach instrumentation on our equipment and just as importantly, how do we communicate the purpose of the instrumentation?”

Cost is another issue – if a sensor costs $5,000 instead of $500 it might still be seen as an unnecessary optional extra despite the insights it can bring. Again, this is if the customer is only looking at it from the operations perspective and not necessarily realising the benefits it could bring to the maintenance side. Another aspect of instrumentation is ensuring adequate maintenance and upkeep for the actual instruments themselves maintain accuracy and effectiveness. Sensors can become caked in crud and dust. This might be a problem when you are dealing with optical instruments, lasers and X-Ray sensors. Condition monitoring of sensors is also not just about the mechanical aspect – often inaccuracies or problems are due to communication errors or I/O interface issues. Mineral concentrators do not always have the high bandwidth wireless connectivity people assume.

Many of the world’s biggest mines have moved responsibility for process control to integrated remote operations centres – often hundreds or even thousands of kilometres from the actual plant. High level decisions are now taken in IROCs, with the onsite control room really just an emergency back up in case of loss of connection. Is that driving greater demand for data solutions as well?

Matinlauri: “I think it is still a mixed situation. What I’ve seen so far in some of the ROCs is that it’s more of a lift and shift from site to remote and it’s still operations driven – the maintenance and reliability teams are still at the site.” He adds: “I think that’s the next step that needs to happen. For example, we are lookig at options to bring Metso into the customers’ ROCs. If you think about it, we have field service at customer sites all the time. Going forward, instead of having Metso Performance Centers only at our own offices, for large mines – we could have Metso condition monitoring experts at the ROC. Those experts can also have our support network behind them, and access to a vast pool of Metso expertise, all the way to the individual product managers. Of course we can train customer staff as well, but most likely it will be a combination of the two.”

Matinlauri said he sees this starting to happen within the next five years and it is part of the discussions that Metso is already having – it just has not been realised yet.

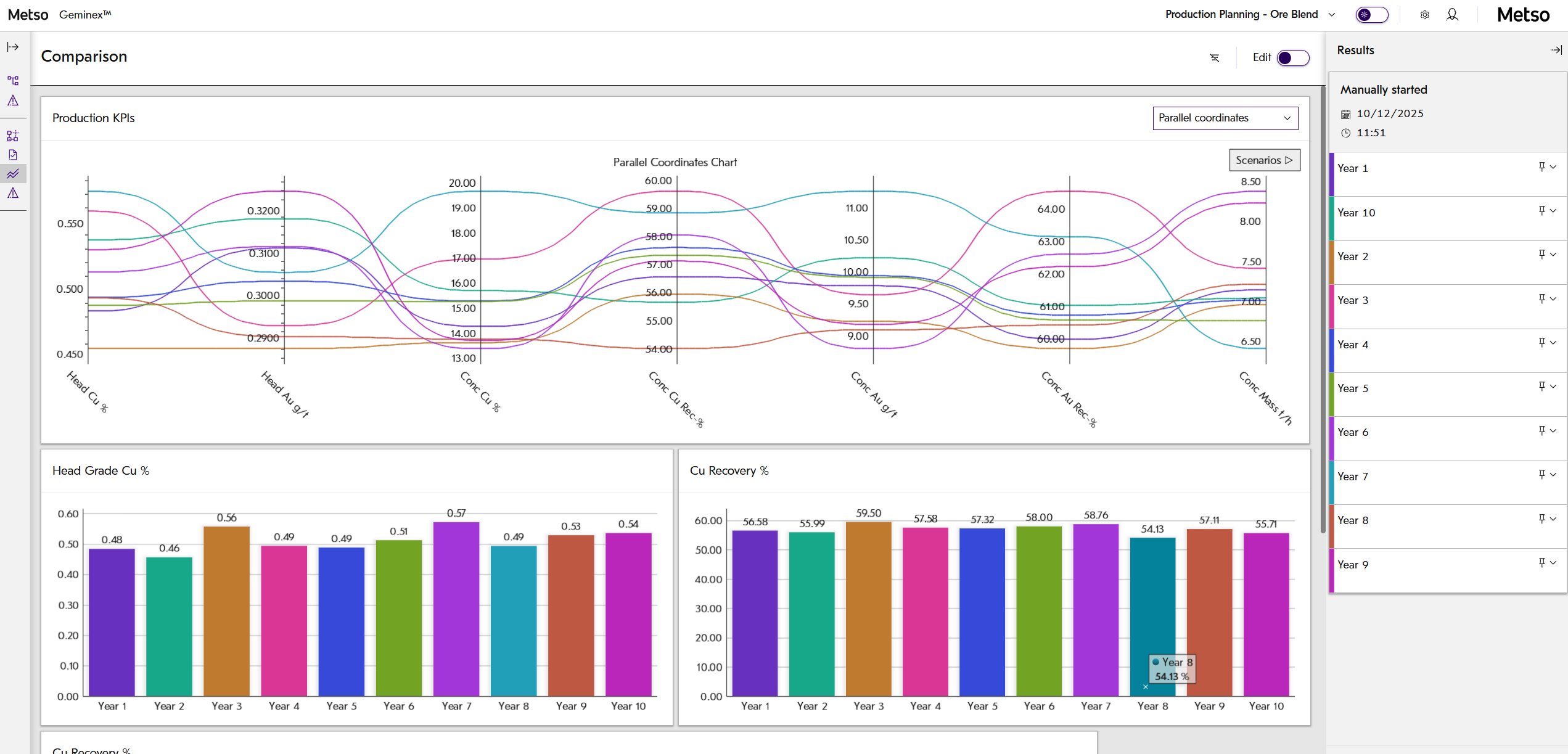

Comparison simulations for long terms planning in Metso Geminex

What about the fact that no processing plants have 100% Metso equipment? Customers will not want multiple different processing equipment OEM experts in their ROC locations. “That is a good point and I think it comes down to the particular scenario and this development is likely to be with certain customers that have gone all in with Metso to a greater extent – that said given our size and scope, we already monitor third party equipment at a number of sites – the baseline being where we have some significant play there as the capital equipment supplier. We aren’t going to become a purely condition monitoring company. But again it depends – a good example is a large miner that might have three concentrators – two of which are dominated by Metso equipment, but one isn’t, we might still monitor all three, and this is something we are already doing.”

The most fascinating part of the discussion was what the future might bring in terms of insight capabilities and how that will enable planning strategies in the concentrator. Mine sites have been using short interval control for years – where they use data, digital tools like fleet management systems, and focused reviews, over very short time intervals – sometimes every hour – during a shift to identify any production issues, and therefore optimise cycles and equipment deployment. It allows mines to keep to their targets and KPIs.

Even today, concentrators are generally not doing this – it is still a case of ‘we’ll see in the end what type of recovery we got based on what feed we had.’ Metso is changing this with technologies like Geminex™ and HSC. Geminex is a metallurgical digital twin that combines operational data and expertise, delivering insight-driven performance that gives more efficient management of variability.

HSC was actually one of the first software packages to combine versatile chemical, thermodynamic, and mineral-processing features. Thermochemical calculations are useful, for example, when developing new chemical processes and improving existing ones. HSC also contains modules for mineral processing and particle calculations, which are integrated with an extensive mineral database. Modules and databases are accessed via a dynamic and fully customisable menu. The latest HSC Chemistry™ software contains 24 calculation modules connected to 12 integrated databases. It allows users to develop new processes and improve existing ones through modelling and simulation.

But the reality is that the market by and large doesn’t yet understand the potential and power of these digital tools, even though they have been around for a while – and many decades in the case of HSC. “HSC is the simulation engine at the back of it all. Development started in the 1970s, encompassing hundreds of thousands of lab measurements – but today we have vastly improved the simulations thanks to current computing power and the power of AI plus we can base it on the latest Metso process equipment.”

You can simplify Geminex portfolio to three main areas, Matinlauri says. First operator training simulators – whenever a customer starts up a new plant, Metso actually has the flowsheet and simulations that it can make available through the operations user interface, the DCS automation system. “Secondly, with Geminex we can do long term, and mid term simulation – monthly, quarterly, yearly simulations that allow you to adjust your ore body parameters based on the mine plan, sampling data and the block model – so you can input expected grade, hardness, abrasiveness, clay content – a long list of data on what you’re going to be getting into your concentrator over a period of time and then adjust the operating parameters – how you’re going to run the plant. In some cases over the long term you might use it to redesign your process, such as adjusting your fine grinding and flotation.”

Third is the already mentioned area of short interval control and this is a big focus for Metso today: “Taking live data coming into the system, and based on that, creating scenarios for the following 24 hours on how can you adjust the plant operation based on expected feed changes, and based on that, what are the recovery results you’re going to be getting? Plus what is the overall status of your process at any one time?”

Matinlauri pointed out it’s not only about the process – you can also simulate against mechanical topics. “You have five comminution trains of grinding mills. One is going to be down for the next 24 hours due to a problem or scheduled maintenance. What’s the best way of operating the plant in that condition?”

With Geminex you already have a live process view, so you can see what’s going on in the process. “But what we are interested in and where we are taking Geminex is detailed simulations, so you’re able to define different types of changes in operating mode. They can be univariate, they can be multivariate. It could be 20 different parameter changes. You’re able to define in our tool which scenarios you want to simulate, and if you want to do it periodically or define it manually.”

Once you’ve run the simulations, you’re able to actually see the results. For example, what is your final copper concentrate percent going to be. “You can compare all the different scenarios and process stages over time and make decisions on what are you wanting to optimise. And therefore, instead of let’s see what happens, you’re really able to plan it. Once you’ve defined the scenarios and decided which way do you want to operate, you’re able to easily see moving forward how the process is going to change and what the end result is going to be. We store all the data of the run simulations and compare them with actual results. And the validation levels are very high – the simulations are very accurate.”

To what extent is Geminex being used in the market today? “It is relatively new and in the early stages – slowly but surely we are bringing clarity to customers on its potential. There are a handful of customers who have been using it for several years on a full live shift by shift basis. They are already doing their shift operations planning with Geminex.” Matinlauri said that this has been with small to mid-sized customers, for example in gold mining. Now the next stage is going to be a rollout to the very large throughput customer cases such as copper and iron ore.

Finally, there is also a sustainability aspect with Geminex, as more efficiently handling variable ore types can allows for significant savings in energy, water and chemicals per produced ton of product. It is also modular to allow for phased implementation, and integrates easily with existing infrastructures, cyber security and IT policies.