For companies and investment funds following the Brazilian economy, there are a wealth of current and short-term indicators available. But in order to make sense of the data, it is necessary to lift the bonnet and have a deeper look at the workings of the economy that takes a longer-term perspective.

Since 2014, growth has averaged 0-1% per annum in the Brazilian economy. In practice, it needs to grow 4-5% a year to meet its various social and economic challenges. We look at the underlying causes of this underperformance here.

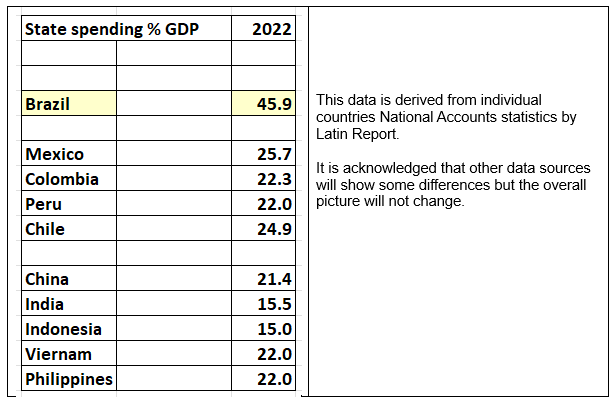

While there are many possible interpretations for this outcome, our view is that Brazil is a total outlier in the developing world in terms of the State share of the economy:

Brazil, then, has a State share of the economy similar to France or the Scandinavian countries but unknown in the developing world.

The are two main reasons for the high State share of the economy – (i) high real interest rates, and (ii) public pensions. Let’s look at each of these in turn:

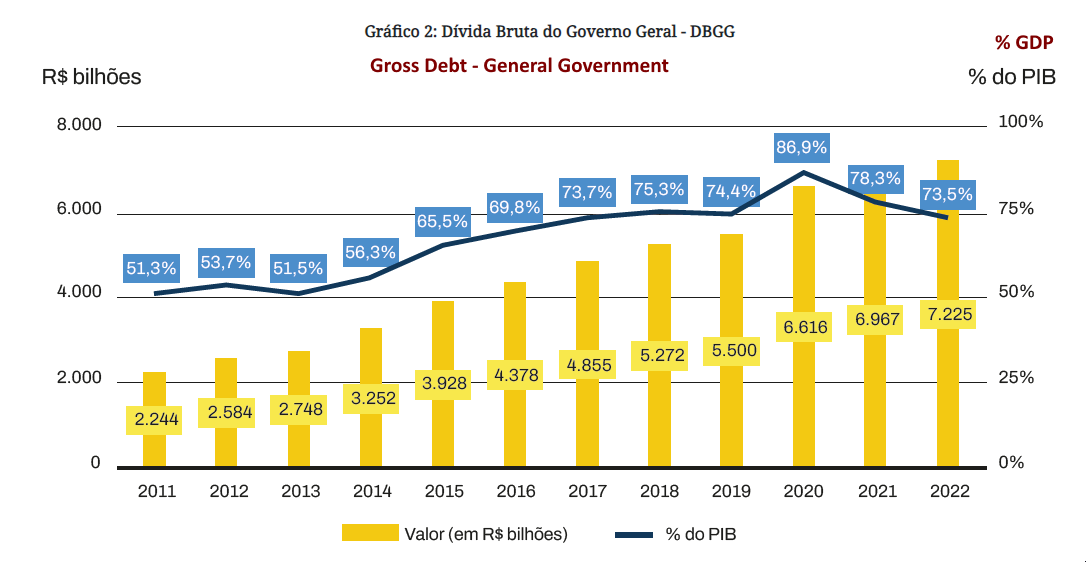

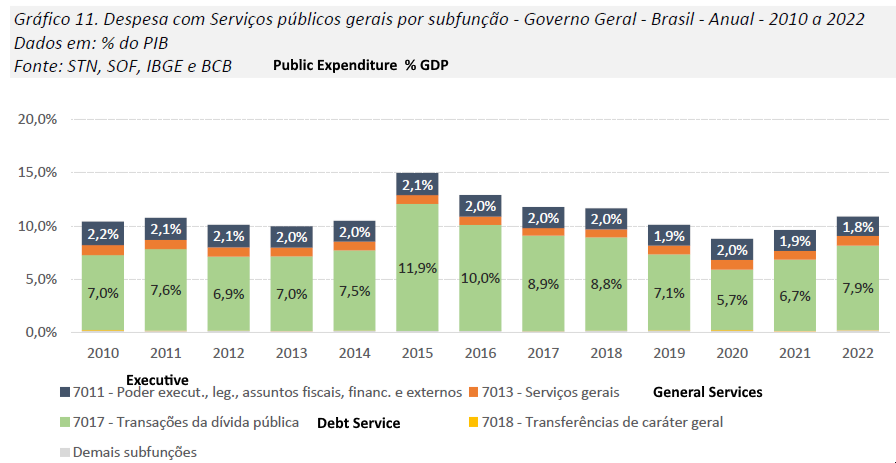

The chart above shows that General Government debt in 2022 was 73.5% of GDP and the chart below shows that the debt service cost in 2022 was 7.9% of GDP which is equivalent to an interest rate of 10.75%. Note that debt is around 100% of GDP in the US & UK and the interest cost is around 3%.

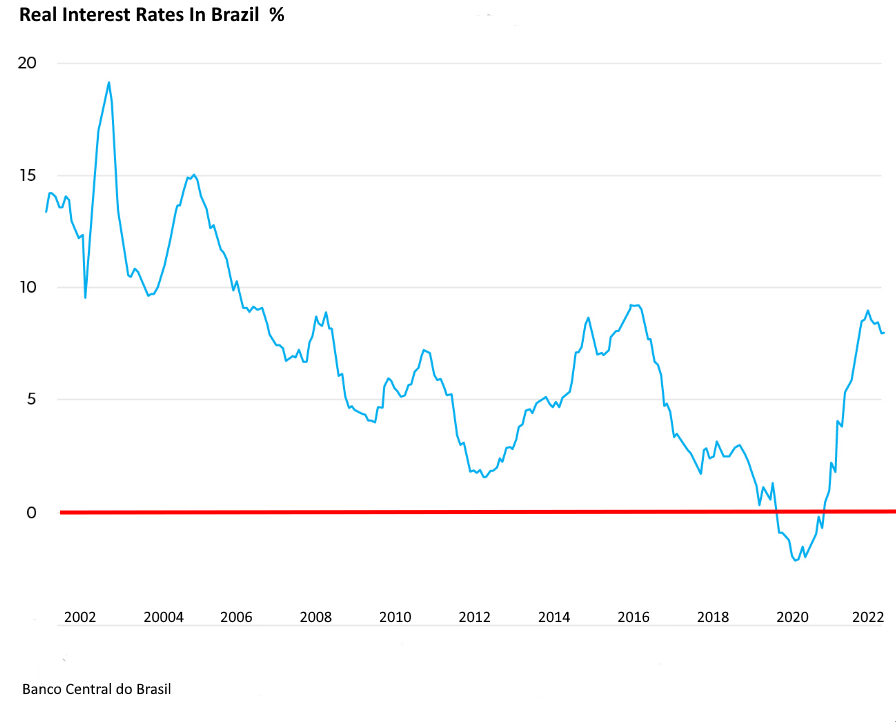

Brazil has a long history of high real interest rates – see chart below.

In our report, we quote an IMF paper which attributes the underlying cause of high real interest rates in Brazil to the high State share in the economy, and this brings us to our second topic which is pensions.

In a number of European countries, there is a State earnings related pension system under which workers contribute to the Social Security throughout their working lives and then draw a pension based on their contributions. This means that the cost of pensions is borne by the State, and this contrasts with private pension systems whereby contributions are made to private funds and these are responsible for paying benefits.

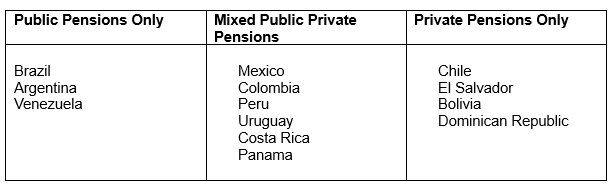

In Latin America we have the following breakdown of pension systems (ChatGPT):

With regard to the countries which have purely public pension systems, we will be dealing with Argentina in a subsequent post and Venezuela can be considered a failed State where public pensions are worthless due to years of hyperinflation.

In Brazil, workers pay between 7.5% and 14% of income to the Social Security, depending on income, and the employer contributes a further 20%. In spite of this, the Social Security Funds and Pension Funds are heavily in deficit. Contributions cover 61% of pensions outgo, and this scenario will worsen as the population ages.

Beyond Social Security, taxes in Brazil are very high and very little of the State budget goes to investment; rather, it is almost all current expenditure.

If Brazil wishes to break this cycle of little or no growth it needs to:

- Increase the national savings rate

- Invest the increased savings in infrastructure to reduce the cost of doing business

- Reduce the State share in the economy to allow the real rate of interest to fall

In our view, the only way of achieving these goals is to move the system of pension provision into the private sector. Politically this would be very difficult to achieve as it is almost impossible in a democracy to row back on what people were promised. However, there are some things that could probably be undertaken within the existing constitutional framework:

- Young people entering the workforce contribute to individual retirement accounts rather than the State Social Security such that the system privatizes over time

- Companies could be allowed to pay a reduced rate to the Social Security provided that the savings are paid into private pension funds

Both of these moves would increase the National savings rate and over time reduce the State share in the economy. The Brazilian political system has its hands tied behind its back due to the ongoing fiscal burden and there is no way out unless they move in this direction.

Read our full report Economy of Brazil 2024 for more information.

About the Author: Paul Dixon is the founder of Latin Report. His economics articles on a wide variety of topics are very widely read and are often found ranking in search results for months and even years after first being posted.

Latin Report tries to make sense of the vast volume of information available to understand country economies. Our reports are written from a long-term perspective and track a country’s evolution over a number of decades. We mostly let the data tell the story with commentary on political events to illuminate features of the data. Latin Report aims to express views that hold their value over time and should therefore assist companies making long term decisions. This compares to competitors’ reports based on current analysis which are subject to continual revision.