How effective is buy-and-burn as a number-go-up mechanism? And is it effective enough to counter the number-go-down pressure of token unlocks? This post explores the opposing pressures and describes the concept of an equilibrium price, where, all else begin equal, the opposing forces neutralize each other.

Buy-and-burn has long been regarded by the crypto community as a method to transmit value from a project to tokenholders without the token itself being considered a financial security consequently*.

How token buybacks and token unlocks mechanically impact price? We can compare the dollar value of these two opposing forces. If they balance, and all else being equal, then there should be a net zero impact on the token price. If one outweighs the other, then there is corresponding pressure on the coin price.

Example Project

Take a hypothetical project with the following characteristics:

- Monthly revenue: $1,000,000

- Monthly tokens unlocked: 1,000,000 tokens

- Current spot price: $5.00/token

Note that market cap, FDV, token supply, circulating supply, are all irrelevant in this exercise.

Assumptions:

- Let’s assume that 80% of revenue is used for buybacks (the other 20% is used to fund salaries and expenses etc). Usually the project will signal how much it intends to spend on these schemes.

- Let’s assume that 70% of tokenholders will want to immediately sell their tokens on unlock (the other 30% want to keep their tokens for the long term). This is an estimate, as no one knows what everyone else will do.

Implications:

Ammo for buying tokens: 80% x $1,000,000 = $800,000

Tokens to be sold: 70% x 1,000,000 tokens = 700,000 tokens to be sold

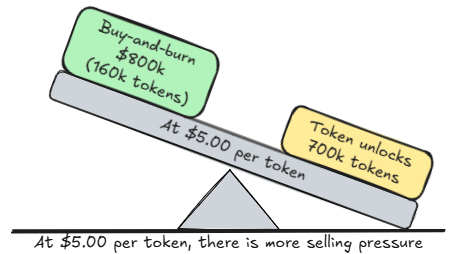

At $5.00 Token Price

At a spot price of $5.00 per token, we can derive a number of implications.

- The project can buy a maximum of 160,000 tokens ($800k ammo / $5 per token)

- Main caveat: Typically fewer tokens can be actually purchased because the act of buying would move the token price up

- So there will be 540,000 tokens remaining to be sold into the market (700k to be sold – 160k soaked up by project)

- The impact of the spillover selling is likely to push the price down, but has an unknown impact to the market. Liquidity (market depth) is the key factor on how this might impact the price. It could have minimal impact to the price, or could send the price to zero.

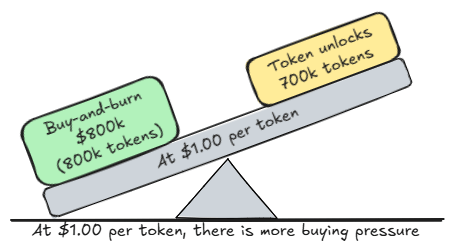

At $1.00 Token Price

But what if the spot price of the token was $1 per token? We could re-run the analysis:

- The project can buy a maximum of 800,000 tokens ($800k ammo / $1 per token)

- So after buying 700,000 from unlockers, the project will be able to buy 100,000 tokens from the market

- The impact of the spillover buying is likely to push the price up, but has an unknown impact to the market.

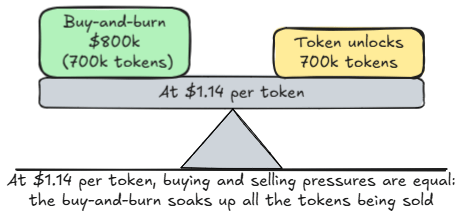

Equilibrium price

There is a theoretical equilibrium price, $1.14 per token at which the buying and selling activities balance out and have net zero impact on the market. At this spot price, the project’s buying power exactly buys all of the tokens that tokenholders want to sell. In this case, 700,000 tokens ($800k ammo / $1.14 per token).

How do you derive the equilibrium price? The simple formula is: buying dollars divided by selling tokens. In this case, that’s $800k / 700k tokens = $1.14 per token.

The equilibrium price is not “here is what the price *should* be”. It’s not “this is where the market will end up after the buying and selling is complete”. After all, intuitively the buying of 100 BTC can move the market a little or a lot, depending on market conditions. It’s simply the price at which the buying and selling would cancel each other out.

What you can say is that if the market price is below the equilibrium price, the buy-and-burn activity should outweigh the selling activity of unlockers, which should have a positive effect on price. And if the market price is above the equilibrium price, then the activities should have a negative effect on price. And if that’s the case, you could say that all else being equal (which it never is), then it is the price which the combination of buybacks and token selling pushes the market towards.

Of course, many other factors are at play here. While this post has only explored one aspect of the mechanics of value transmission, narrative is important and drives a lot of investor behaviour. The prospect of a fee switch to turn on buy-and-burn to drive future value is enticing to investors and may be enough to turn a token seller into a holder or even buyer, which changes the dynamics. And, of course, with many projects, token unlocks only happen during a certain period (say 3-4 years post TGE) after which there is no more sell pressure from unlocks, so we are only left with the buy pressure from buybacks to meet other market forces.

Pick your favourite buy-and-burn project. What’s their equilibrium price?

* If I have a revenue generating business and I commit to the world that I will take some amount of revenue from business and use it to buy (and destroy) gold, coffee beans, garden chairs, origami napkins etc, that doesn’t, in itself, make those objects become financial securities. Of course situational facts matter when determining if something is a security or not, and this is an observation rather than legal or financial advice!