- Bitcoin’s long-term returns remain strong, signaling sustained investor conviction.

- Retail investors continue to build conviction, strengthening holding patterns.

Investors didn’t always consider Bitcoin [BTC] a store of value. In its early stages, it traded more like a high-risk, high-reward asset, driven largely by speculative interest.

Yet as Bitcoin matures into a trillion-dollar asset class, now competing with the likes of the “Magnificent Seven,” it continues to deliver remarkably resilient cycle-by-cycle yearly returns.

Does this suggest that underlying demand is scaling in lockstep with Bitcoin’s market maturity?

Bitcoin defies size with persistent returns

At the 2022 cycle low, one Bitcoin traded at around $17,000. At press time, that same BTC commanded a price of $105,000, representing a 517%+ increase in just over two years.

While the return profile is undeniably strong, the capital required to participate in this upside has scaled dramatically, too.

In other words, acquiring a single BTC now demands more than five times the investment it did in 2022, presenting a much higher entry barrier, especially for retail participants.

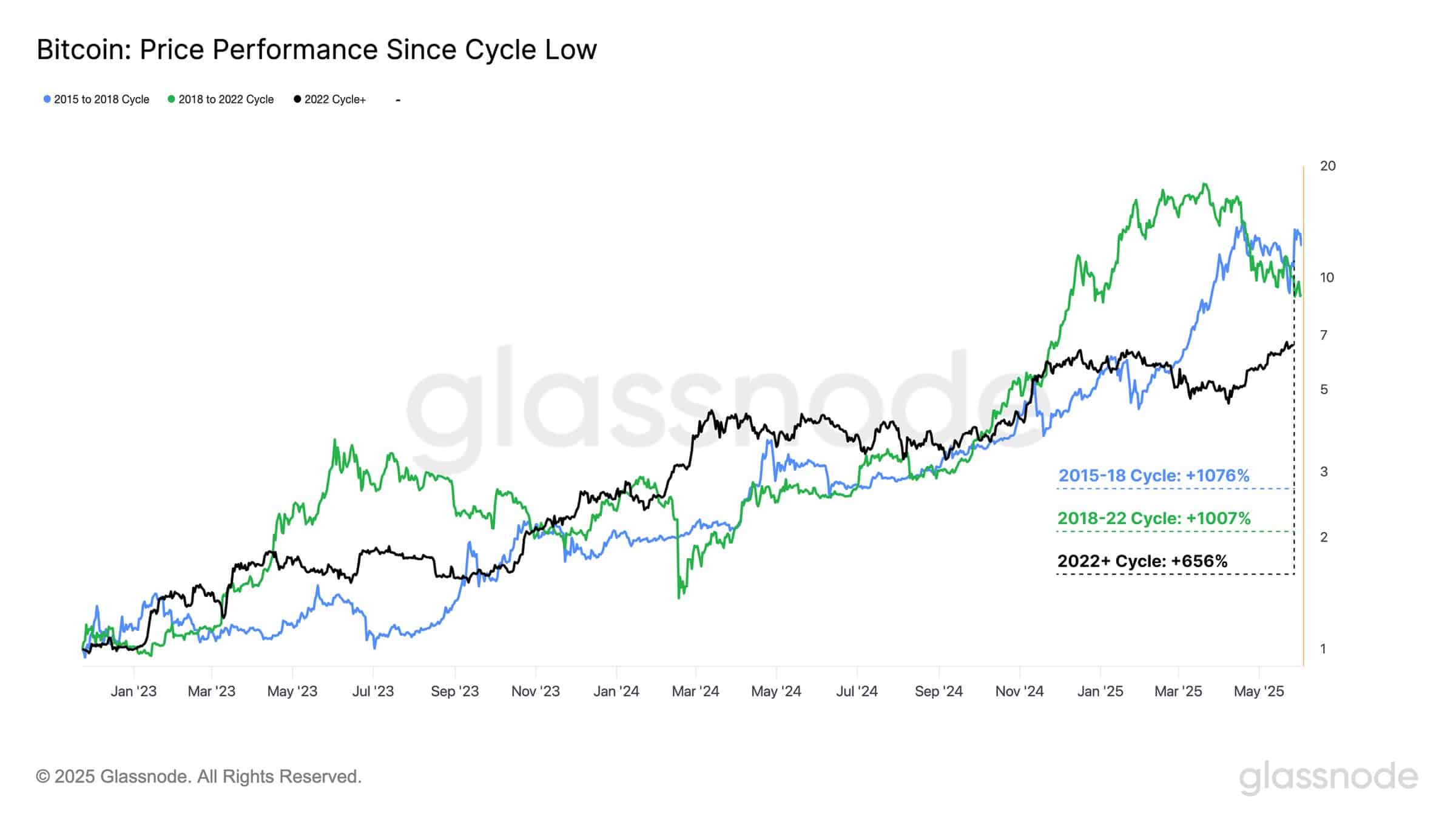

Yet, Glassnode’s data reveals that since the 2022 cycle low, Bitcoin has generated a 656% return, indicating that long-term holding continues to deliver substantial yields despite higher capital threshold.

Source: Glassnode

And we’re only halfway through 2025. Zooming in on the chart, Bitcoin’s current cycle performance isn’t far behind past runs, whether it’s the 1076% gains from 2015–18 or the 1007% from 2018–22.

This consistent return pattern plays a crucial behavioral role. It gives long-term holders confidence to stick around, while also sparking FOMO that pulls new investors in. That mix keeps the market energized and moving.

Retail investor behavior reflects market strength

Sure, institutional interest in Bitcoin has expanded significantly quarter-over-quarter, reflecting its transition from a speculative asset to a mature, long-term value driver.

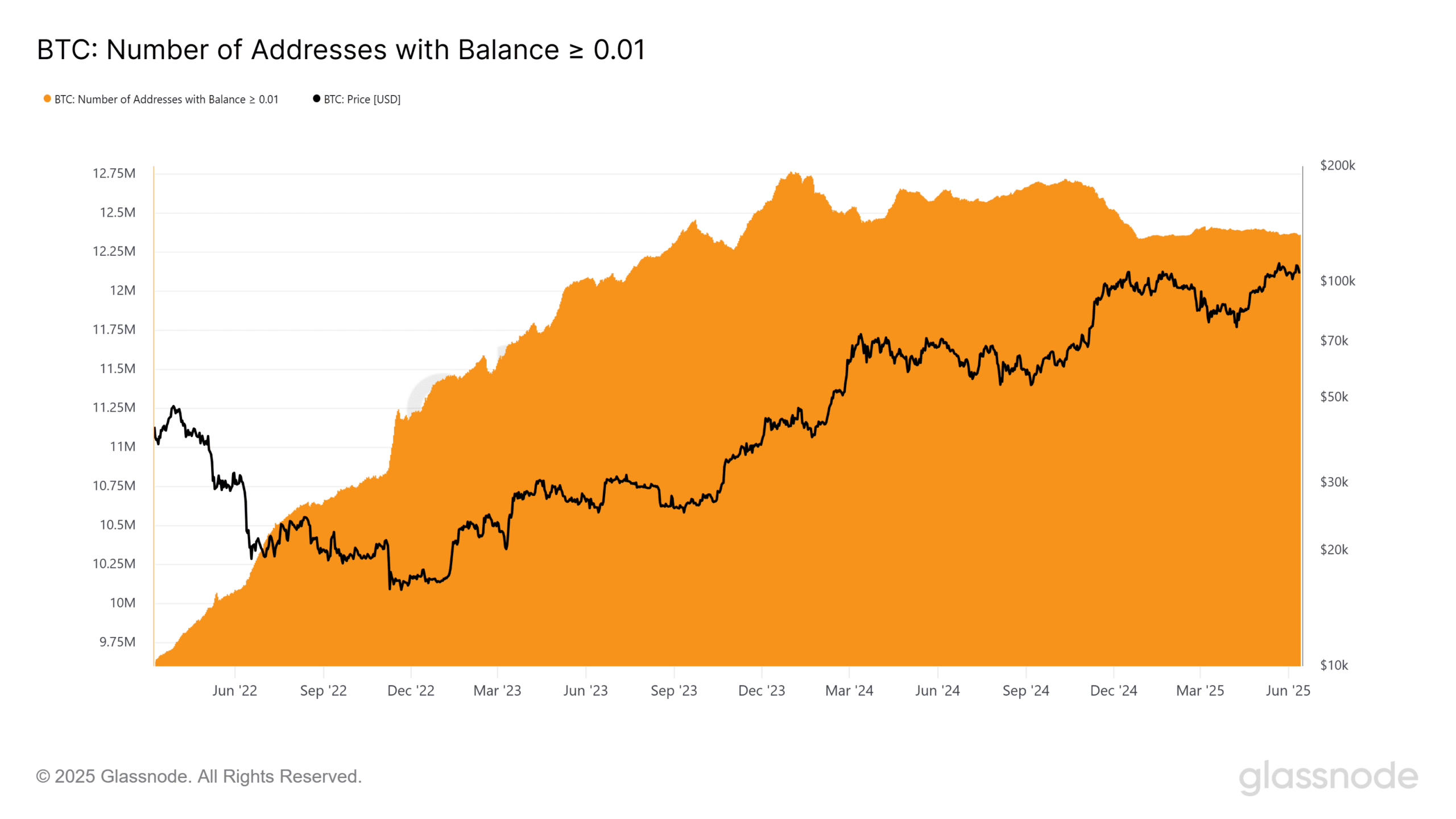

Consequently, you might think retail investors would recede as institutions accumulate. However, on-chain data reveals a notable increase of approximately 33% in addresses holding more than 0.01 BTC over the past two years.

Source: Glassnode

Additionally, the number of addresses controlling more than 1 BTC recently surpassed the 1 million mark, signaling expanding accumulation across both retail and institutional cohorts.

This persistent buildup, despite Bitcoin’s elevated price, indicates strong conviction across market segments.

Smaller holders are actively scaling positions, betting on outsized future returns that justify the significant capital commitment, thereby reinforcing Bitcoin’s resilient HODLing framework.