Airdrop farming in 2026 is not the same game it was a few years ago.

And honestly, that’s a good thing.

The easy money days of clicking a few buttons and waking up rich are gone. In their place, we now have something more sustainable. Something more fair. Something that actually rewards people who show up, use products, and contribute to ecosystems.

We’ve been writing airdrop farming guides for years. In 2024 and 2025, we published deep strategy pieces that helped thousands of farmers position early. Over the last four weeks alone, we’ve been on a strong roll again. More stories. With more data. And more hard lessons from the field.

This is the Airdrop Farming 2026 edition.

Updated for current trends. Updated for what actually works now. Written from the perspective of someone who has farmed through multiple cycles.

What Is Airdrop Farming in 2026?

Airdrop farming is the strategic interaction with early or growing crypto projects in order to qualify for future token distributions.

In 2026, that definition comes with one important addition:

Projects are no longer rewarding random behavior.

They are rewarding wallet narratives.

That means:

- Consistent usage over time

- Real economic activity

- Participation across multiple parts of an ecosystem

- Proof that you are a real user, not a script

If your wallet looks like a bot, you will be treated like one.

If it looks like a real user, rewards tend to follow.

Note: Always keep your wallet clean by regularly removing unused approvals using tools like revoke.cash. From a security standpoint, we used to rotate wallets every few weeks. However, the trend is shifting toward rewarding long-term, consistent on-chain users. Because of that, maintaining a main farming wallet now makes more sense — as long as security remains the top priority.

Why Airdrop Farming 2026 Is Different

The shift started in 2024. It accelerated in 2025. In 2026, it is fully visible.

Projects are:

- Filtering harder

- Tracking behavior patterns

- Reducing rewards for shallow farming

- Increasing rewards for long-term contributors

The strongest farmers today are not the loudest.

They are the most consistent.

This is why fewer wallets, better strategies, and smarter capital deployment are outperforming brute-force farming.

Related: Why airdrops are replacing altcoin investing.

The Core Principle: Build a Wallet Narrative

Your wallet is no longer just a tool.

It is your reputation.

Projects look at:

- How often you interact

- How diverse your actions are

- Whether you return over time

- Whether you use features as intended

- If you’re a multichain user

One swap does not tell a story.

Six months of activity does.

This single mindset shift already puts you ahead of most farmers.

Ecosystem Focus Beats Scatter Farming

One of the biggest lessons from recent years is simple.

Deep farming beats wide farming.

Instead of touching 50 random protocols once, strong farmers:

- Pick 2–3 ecosystems

- Use most major apps inside them

- Participate across DeFi, NFTs, governance, and tooling

This creates a dense on-chain footprint.

Projects notice that.

Testnets Still Matter

Testnets remain one of the best risk-free ways to farm.

They require time, not capital.

And when projects reward testnet users, the payouts are often surprisingly generous.

The key is not just showing up once.

It is coming back across multiple testing phases.

You can easily find these in our browse section and filter on testnet.

2026 Airdrop Farming Categories

A. Infrastructure & Core Protocols

These are still the backbone of airdrop farming.

Think:

- Wallets

- Bridges

- Oracles

- Cross-chain infrastructure

- Developer tooling

These projects create massive value, and they often reward early users generously. Even if a token is not confirmed, usage still matters.

B. DeFi Participation

Classic DeFi farming is alive and well.

Lending, borrowing, staking, LPing, and governance all signal real economic activity. Projects still value this highly, especially when activity is repeated and intentional.

C. Prediction Markets (A Quiet but Powerful Farming Angle)

Prediction markets are one of the more underrated airdrop farming categories going into 2026.

These platforms reward users who actively participate in:

- Market creation

- Trading outcomes

- Providing liquidity

- Consistent engagement over time

What makes prediction markets attractive is that they combine real usage with verifiable on-chain behavior. You are not just clicking buttons. You are taking positions, expressing opinions, and contributing to market discovery.

From a farming perspective, this is gold.

Projects in this space tend to value:

- Repeat users

- Diverse market participation

- Long-term engagement across multiple events

Another advantage is capital efficiency. You do not need a large size to be considered a valuable user. Even small, thoughtful positions can build a strong activity profile.

Prediction markets also fit perfectly into the broader trend we are seeing:

protocols rewarding users who help build meaningful on-chain data, not just volume.

We continue to watch this sector closely, and historically, outcome-based platforms have been very generous to early and active users when tokens eventually launch.

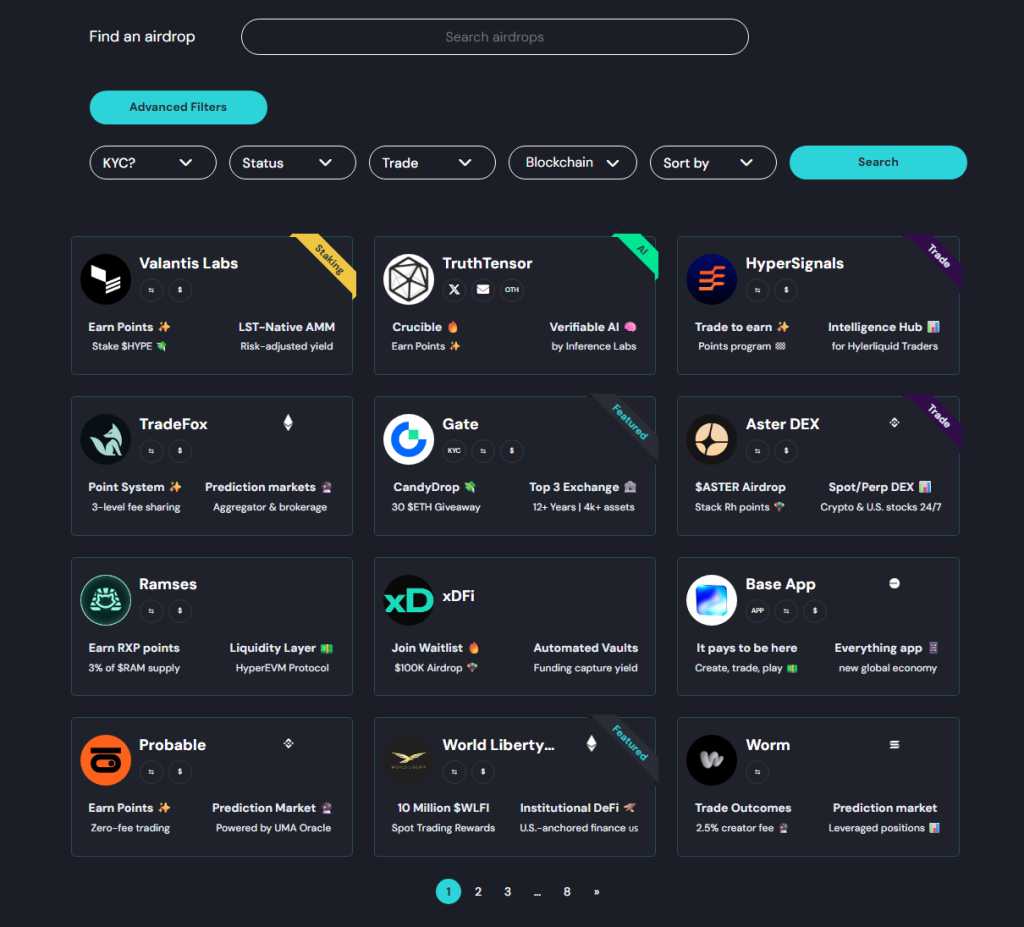

The current big players are Polymarket and Kalshi, but there are a dozen other farming opportunities. On Airdrop Alert, we always list the potential good airdrops, so stay active.

D. Dex Farming & Trading Airdrops

The Biggest Trend Right Now

Dex farming is currently the most dominant trend in DeFi airdrop farming.

Point systems are everywhere.

Neutral strategies are the norm.

And volume matters more than ever.

Platforms like Hyperliquid, Lighter, and Aster have already distributed hundreds of millions to billions of dollars to users. Rewards were based on:

- Trading volume

- Number of trades

- Consistency

- Other on-chain metrics

This has naturally attracted big whales. Very big whales.

There are at least 20 DEXs with active or upcoming point systems right now. Farmers generally have two options:

- Find under-farmed DEXs with less competition

- Or farm the big names, knowing they will do large airdrops, but you will receive a smaller slice

Both strategies work. The right choice depends on your capital, risk tolerance, and time commitment.

E. NFT, Gaming & Gamified Engagement

NFT farming has evolved.

This is no longer about minting something once and hoping for a miracle. Real utility matters now.

Projects reward:

- Event participation

- Play-to-earn mechanics

- On-chain achievements

- Community builder roles

Gaming deserves its own mention

Gaming airdrops are cyclical, but reliable.

Since 2017, almost every year has delivered at least one very rewarding gaming airdrop. The hard part is not playing. The hard part is identifying the right game early.

The upside is clear:

- Most gaming farms require no capital

- You trade time instead of money

- And it can actually be fun

Even if only one out of ten games pays off, the ROI can still be excellent.

F. Meme, SocialFi & InfoFi Projects

This category is riskier, but still relevant.

Community-driven protocols continue to reward:

- Early evangelists

- Builders

- Contributors

- Content creators

The key is quality engagement, not pumping for airdrop proof.

Right now, this sector is dominated by AI slop. Low-effort posts and fake engagement are everywhere. Because of this, verification standards are tightening fast.

That said, InfoFi remains one of the easiest ways to earn airdrops without capital. If you provide real signal instead of noise, opportunities still exist.

CEX Bonus Farming & Trading Rewards

Centralized exchange farming is back in a big way.

Many traders now use neutral or hedged strategies to:

- Offset market risk

- Farm fee rebates

- Earn trading bonuses

- Position for future exchange airdrops

When done properly, these bonuses are often positive EV, even after fees. Once you include potential future airdrops, the math becomes even more attractive.

Trading Knowledge That Improves Farming Results

If you are farming DEXs or CEXs, trading knowledge directly impacts your ROI.

Useful topics to study:

Better decisions mean longer survival. Longer survival means more airdrops.

Find more Trading Guides here.

Wallet Farming Is Back

Wallets are quietly becoming one of the strongest farming categories again.

With:

- A MetaMask token pretty much confirmed

- A Rainbow TGE expected soon

You should be selective about which wallets you use.

Security always comes first.

But once you trust a wallet, it makes sense to actively use it with the assumption that wallet airdrops are coming.

Wallets worth researching and using intentionally:

Using wallets as part of your daily on-chain flow is one of the easiest passive farming strategies.

Airdrops Are Not “Get Rich Quick”

Airdrop farming is a grind.

Some weeks you get nothing.

Some months feel slow.

But:

- It is more consistent than trading altcoins

- It is less risky than chasing memes

- And the long-term ROI is very real

Do not expect overnight success.

Set clear goals.

Manage your time and capital.

Keep farming.

Rewards usually arrive later.

Support Our Work

If you found this helpful, consider signing up on BloFin (Non-KYC) or Bybit using our referral links. Your support keeps this content free and flowing.

Personal Note From an OG Farmer

I’ve been in crypto since 2013.

I’ve been farming airdrops since 2016.

And I’ve been running AirdropAlert since 2017.

I’ve seen over 30,000 projects. At this point, there are very few surprises left.

I have never seen a clearer shift toward airdrop farming than what we are seeing today.

Crypto trading is getting harder.

Meme coins increasingly reward insiders and botters.

Airdrops remain one of the fairest and most solid ways to earn crypto.

They will continue to evolve with trends.

And we will continue tracking those trends, publishing guides, and helping you get in early.

That part hasn’t changed.

Final Words

Airdrop farming in 2026 is no longer a side hustle for bored traders.

It has become a serious, repeatable strategy.

The rules are clearer now.

Show up. Use products properly. Stay consistent. Manage risk.

You do not need to chase every new thing. In fact, doing less — but doing it well — usually pays more. Focus on a few ecosystems. Build real on-chain history. Learn how to farm efficiently without burning capital or time.

There will be slow weeks.

There will be months where nothing lands.

That is part of the process.

But if you stick with it, airdrops remain one of the most asymmetric opportunities in crypto. They reward patience, curiosity, and discipline — not leverage or luck.

We will keep farming.

We will keep researching.

And we will keep sharing what actually works.

If you stay in the game long enough, the rewards tend to find you.

If you enjoyed this blog, check out our Guide on Looping Strategies to Optimize your farming capital.

As always, don’t forget to claim your bonus below on Bybit. See you next time!